Framrúðuskipti

Við skiptum um og gerum við framrúðuna, líttu við eða bókaðu tíma hér á síðunni.

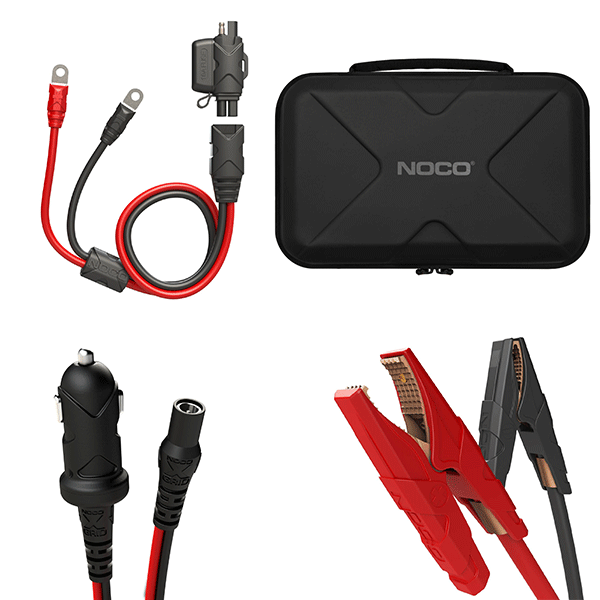

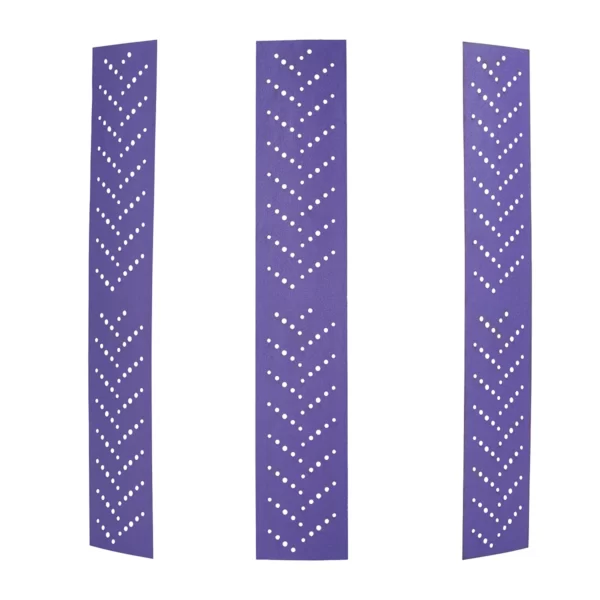

Panta tímaVörurSkoða úrvalið

Valdar vörur

TilboðsvörurSkoða fleiri tilboð

FróðleikurSkoða nánar

Valvoline Hybrid smurolía

Valvoline Hybrid er smurolía sérstaklega fyrir Hybrid bíla [...]

Lesa meira